Health Benefit Rates Plan Year 2023

The Joint Labor-Management Benefits Committee (JLMBC) has reached an agreement regarding employee health benefits for the plan year 2023. The JLMBC is comprised of members from all bargaining units (ACE, CSEA, FA, POA, and Teamsters).

Health benefit premiums are funded through three sources: employee health benefit premiums, the District’s per employee per month (PEPM) contribution, and a rate stabilization fund (RSF) which offsets the difference between employee and District contributions and the actual premium cost. In a nutshell, here are the changes:

- Employee benefit health benefit premiums increase by seven percent. See MOU for Plan Year 2023 employee contribution rates (LINK).

- The District increases their PEPM from $1,062 to $1,132.

- The trial program for Bridge to Medicare allowing reimbursement for health plans outside of CalPERS plan ends December 31, 2022. All other components of the Bridge to Medicare plan remain the same.

- With funding from the state specific to part-time instructors for health benefits, the District increases the PEPM they pay from 40, 50 or 60 percent of the full cost of the premium to 50, 60 or 70 percent for eligible part-time instructors. The percentage depends on the class load a part-time instructor teaches.

- Develop a formula-based approach to fund the RSF and employee benefits in the future.

Plan Options

All plan options remain the same for the 2023 with an overall cost employee premium increase of seven percent. Blue Shield Access+ HMO and United Healthcare Alliance premiums will decrease by 65 percent to bring employee contribution rates in line with similarly priced plans. For retirees, a new Kaiser Senior Advantage Summit HMO has been added.

It is important to remember that the bargaining units and the District negotiate who pays how much based on CalPERS’s plan options but neither has any say in what plans they offer, the cost of a plan including deductibles and co-pays, or what practitioners are included in those plans.

Rate Stabilization Fund

This year saw another large increase (eight percent) in heath benefit premiums from CalPERS . We are projecting a $3 million drawdown to the RSF, leaving a little more than $3 million in the fund at the end of 2023. To keep the fund viable, over the past six years the bargaining units have been able to negotiate an additional $2.8 million in one-time money to the RSF and increase the amount the District’s PEPM from $976 to $1,132. Employee premiums have gone up twice during that same time. The RSF is the mechanism that keeps premium rates manageable.

This year negotiating funds for the RSF has been more challenging. There is money available. The District’s tentative 2022-23 budget identifies nearly $19 million in discretionary funds from its projected $32 million stability fund balance. The 2022-23 state budget has multiple one-time funding options and eliminates the fiscal cliff when hold harmless funding runs out in 2024-25. For example, the part-time health benefit funding from the state would actually save the District money. FHDA’s budget challenges – we’ve lost $10 million in ongoing funding with our decline in non-resident enrollment – and the District’s fiscally conservative/risk adverse nature leaves them unwilling to negotiate any funding to the RSF until they have a better understanding of the District’s 2021-2022 true ending balance once the cost-of-living-adjustments (COLAs) have been implemented and other liabilities have been fully realized. They are also waiting on further details regarding 2022-23 state budget funding requirements and/or when funding from the state actually materializes, as is the case with part-time faculty health benefit funding.

The good news, the District has acknowledged a shared interest in maintaining the RSF and, up against a deadline for rate submissions to our plan administrator for open enrollment in September, we have agreed to negotiate a formula-based approved to fund the RSF in October.

2022-2023 – ACE Negotiations Update

In June your negotiations team sent a member survey to prioritize items to be bargained for the year 2022-2023. As a reopener year, in addition to Article 8 (pay and allowances) and Article 18 (benefits), ACE and the District can each open two additional articles. For 2022-23, we’ve already settled the COLA at 5.56 percent. Benefits are negotiated jointly with the other bargaining units, and we will resume that process in October. For articles pertinent to ACE, with a 35 percent response rate, the top three issues identified in the survey were:

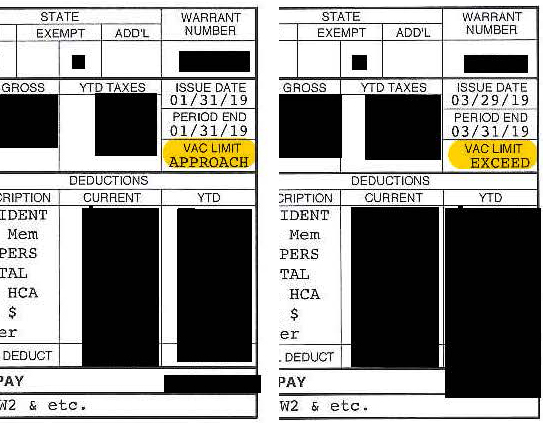

- Vacation accrual

- Remote work options

- Eligibility for promotion

You’ll find a synopsis of the survey results here (LINK). Your negotiating team is researching proposal options around these issues and will keep the membership posted on the next steps and, if necessary, requests for additional membership input.

In Solidarity,

Chris White, chair of negotiations

Negotiators

Sushini Chand

Chris Chavez

Joseph Gilmore

Keri Kirkpatrick

Andrea Santa Cruz

Scott Olsen