ACE Members,

In March we sent a survey to better understand the impact of dentist participation, or lack thereof, with Delta Dental, our dental insurance provider. We shared the results at site meetings (see attached), but in a nutshell:

We had a 70% response rate. Of those that responded, 98% buy into district’s vision and dental coverage.

- 81% of respondents who use district provided dental insurance said their dental provider was still in network.

- 15% of respondents who use district provided dental insurance said their dental provider had moved out of network.

- 4% had always used a dental provider out of network.

There has not been a mass exodus of dental providers. In fact, many more providers have been added than those who have left.

Delta Dental – Provider Updates

Santa Clara County

Delta Dental has 1,961 providers in Santa Clara County. Of those 1,961 providers, 1,292 are PPO + Premier providers.

Of the 1,961 providers, Foothill-De Anza CCD members utilized 641 of the providers in the last 12 months.

There were 36 providers that termed in the last 12 months as follows:

- 25 were voluntary

- 9 were through attrition (Provider being deceased, retired or have moved to another location

- 2 were involuntary (typically due to license issues)

There were 141 new providers added in the last 12 months. Of the new 141 providers added, 14 of the new providers were utilized by Foothill-De Anza members.

Alameda County

Delta Dental has 1,694 providers in Alameda County. Of those 1,694 providers, 1,263 are PPO + Premier providers.

Of the 1,961 providers, Foothill-De Anza CCD members utilized 105 of the providers in the last 12 months.

There were 4 providers that termed in the last 12 months as follows:

- 3 were voluntary

- 1 were through attrition (Provider being deceased, retired or have moved to another location

- There were no involuntary (typically due to license issues) terminations

There were 188 new providers added in the last 12 months. None of the new providers in Alameda County were utilized by Foothill-De Anza members.

San Mateo County

Delta Dental has 732 providers in San Mateo County. Of those 732 providers, 470 are PPO + Premier providers.

Of the 732 providers, Foothill-De Anza CCD members utilized 126 of the providers in the last 12 months.

There were 13 providers that termed in the last 12 months as follows:

- 12 were voluntary

- 1 were through attrition (Provider being deceased, retired or have moved to another location

- There were no involuntary (typically due to license issues) terminations

There were 53 new providers added in the last 12 months. Of the new 53 providers added, 2 of the new providers were utilized by Foothill-De Anza members.

Santa Cruz County

Delta Dental has 229 providers in Santa Cruz County. Of those 229 providers, 184 are PPO + Premier providers.

Of the 229 providers, Foothill-De Anza CCD members utilized 57 of the providers in the last 12 months.

There were 5 providers that termed in the last 12 months as follows:

- 4 were voluntary

- 1 were through attrition (Provider being deceased, retired or have moved to another location

- There were no involuntary (typically due to license issues) terminations

There were 21 new providers added in the last 12 months. None of the new providers in Santa Cruz County were utilized by Foothill-De Anza members

While the impact wasn’t significant on a majority of employees, the Joint Labor Management Council (JLMBC) wanted to see if we could do better and looked into other broker options besides Delta Dental which might bring more dentists into the network.

Carrier Comparison

We found the Delta Dental network is more than double the size of competing providers. If we moved to a different provider, more dentists would fall out of the network, having a significant impact on a large majority of employees.

In reviewing how other providers would compare to Delta Dental, Delta Dental has provided a claim comparison to several other carriers such as MetLife, Cigna, Blue Shield, SunLife, Anthem, etc.

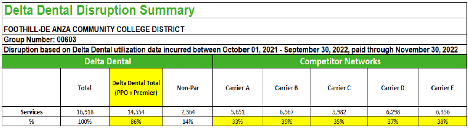

As shown below, there would be significant disruption in the other carrier networks. For example, there were 14,554 services through Delta Dental between October 1, 2021 through November 30, 2022. Of the total 14, 554 services, only 33% of those services would have been considered in-network for Carrier A, 39% in-network for Carrier B, 35% in-network for Carrier C, 37% in-network for Carrier D and 38% in-network for Carrier E.

This is separate from asking the question if we should bargain for increased dental benefits. Changes always come at a cost and IF we were to make any changes, we’d survey the membership. As I’ve said on more than one occasion, you have to give something to get something.

Negotiations 2022-23

With COLA already bargained for this year (5.56%, implemented July 1, 2022) along with health benefit premiums for plan year 2023, we have been slow to get to the table on our other negotiated items. Primarily because HR did not have the bandwidth (getting people paid was a priority) nor did they have a representative to bargain with us. Now that the new Associate Vice Chancellor of Human Resources, Rocio Chavez, has been brought on board, we are starting that process. We have sent our sunshine letter to open negotiations based on the two articles we identified through the membership survey last June: Article 9 – Vacation and Article 13 – Remote Work. Articles 8 – Pay and Allowances and Article 18 benefits are also open and once we have a better idea of the state budget (usually mid-May) we can address any COLA for 2023-24 . We are currently addressing benefit rates though the JLMMC. I am cautiously optimistic the district is now in a position to move forward. We’ll keep you updated, ask for your input as we progress.

In solidarity

Chris, chair of negotiations

Negotiators:

Sushini Chand

Chris Chavez

Joseph Gilmore

Keri Kirkpatrick

Andrea Santa Cruz

Scott Olsen

Chris White (she/her) | Archive Coordinator

Foothill-De Anza Archives | 650.949.7721

Hours: Mon – Thur 7:00 a.m. – 5:30 p.m., Access by appointment only.

Foothill-De Anza Association of Classified Employees (ACE) | Chair of Negotiations