ACE Members,

Personal Cell Phones

Are you using your personal cell phone for college/district business? STOP! 🛑

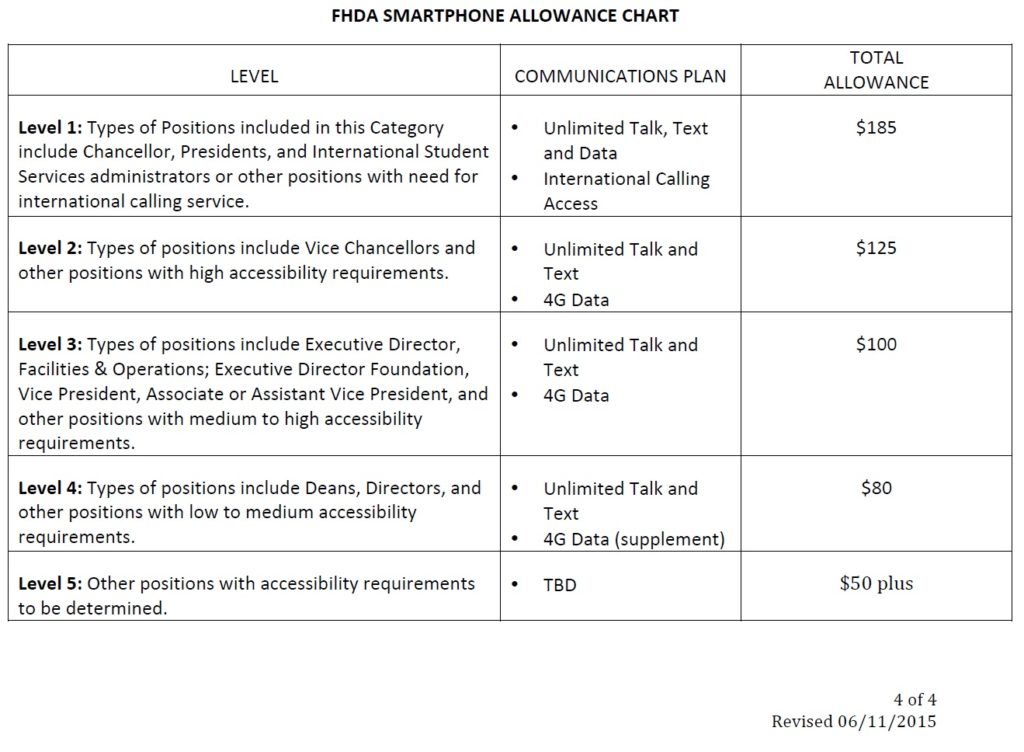

First, there is a district smartphone allowance if calling or texting is asked of you:

If your manager or supervisor is requiring you to use a smartphone as a tool to do your job, the college/district should pay to provide it (and they do for many employees.) Again, STOP if you are doing this for free and ask about receiving the cell phone stipend. The Cisco Jabber desktop application is the method provided for maintaining contact with your supervisor/manager and authenticating using Duo. The onus is on the district to provide what is necessary to complete your work. If Jabber is not functional, let your supervisor/manager know.

Second, you are inviting a workplace related investigation into your personal life if you are using a personal device (phone, computer, tablet, etc.) to store work related text messages, emails, and documents. That device can be seized, and all its contents can be examined. Keep your work data completely separate from your personal data.

The following sections of the agreement in our contract are intended to maintain boundaries if work creeps into your unpaid personal time:

13.2.3 … For the purpose of determining the number of hours worked, time during which the worker is excused from work because of holidays, sick leave, vacation, compensatory time off, or other paid leave of absence shall be considered as time worked by the worker.

13.2.4 Call Back Time

Occasionally a worker may be called back for work in the evening or on a weekend to accommodate a special need. In such cases, travel time to and from home will be counted as time worked. In order to make the disturbance of normal time off worthwhile, the pay for combined work and travel time shall be for a minimum of four hours.

13.2.6.1 Stand-By

No worker shall be required or requested to be available for handling potential emergency situations or available to answer questions by telephone after he or she has clocked out for the day.

13.2.6.2 Compensation for Work Performed after Workers have Clocked Out for the Day

Workers who are contacted by telephone, beeper, or computer after they have clocked out for the day, but prior to 11:00 p.m., to answer questions or handle emergencies from home, shall be paid a minimum of fifteen (15) minutes overtime and shall be paid in quarter hour (15 minute) increments after the first fifteen (15) minutes.

Workers who are contacted by telephone, beeper or computer after 11:00 p.m. to answer questions or handle emergency situations from home shall be paid a minimum of two hours overtime.

Workers who are contacted by telephone, beeper, or computer for emergencies which begin prior to 11:00 p.m., but continue past 11:00 p.m., will be paid the two-hour minimum.

Your supervisor/manager contacting you while you are on leave is not ok.

Contact an ACE steward if you are continuously being asked to use your personal cell phone.

CalPERS Service Credit Purchase

We’ve had a number of former temporary employees join us as full-time employees. You may be eligible to purchase service credit if you worked for a CalPERS-covered employer before you became a CalPERS member. CalPERS has a number of resources on the topic, but the process begins with them:

From “A Guide to Your CalPERS Service Credit Purchase Options” (LINK):

To request your service credit electronically, log in to your myCalPERS account at https://my.calpers.ca.gov/

On the home page under Service Credit, select Make a Service Credit Purchase

Depending on the type of service credit you are requesting, certification may be required

If certification is needed from an employer or reciprocal agency, you and the agency will be notified electronically The agency will have 30 days to provide the required certification to CalPERS

Per Payroll:

Once the request is received in CalPERS, HR validates the employment & position data in the request (if there are errors, it will be rejected) and Payroll completes the pay history by month and HR finishes off with certification within 30 days upon the member’s request.

More Information:

CalPERS Quick Tip | Service Credit Purchase (YouTube LINK)

CalPERS Service Credit (YouTube LINK)

CalPERS Service Credit Cost Estimator (LINK)

For those that have taken a leave of absence, you may also be eligible to purchase service credit. Use cost estimator link above to see if the leave type (maternity/parental, education, service, sabbatical, serious illness.) you’ve taken qualifies.

Fall Mask Policy

Survey results are available here (LINK.)

Quick takeaways:

- 136 of 337 members participated (40% response rate)

- The majority of ACE members do not want covid-19 policy updates on Friday nights.

- The majority of respondents were from public facing offices.

Why did ACE conduct a survey?

To determine what we want as a membership and respond accordingly as representatives. ACE is committed to ensuring the health and safety of our members.

Why would ACE demand to bargain the latest policy?

The district is compelled to negotiate the impact of unannounced unilateral changes when asked to do so by ACE. The survey results speak to our overall concern. We’ve never really known the impact of covid-19 on district employees due to lack of a “covid dashboard” displaying statistics. As such we have submitted an information request for case and exposure data throughout this year. Again, ACE is committed to ensuring the health and safety of our members.

To be honest, I expected this issue would have been resolved within an hour. ACE has a history of arriving at reasonable compromises. At this time district administration is refusing to sit down to have conversation to discuss this matter even after delivering our survey data. In the past we’ve submitted similar feedback to shape policy and been alerted prior to implementation:

Per Judy Aug 16 : “After a robust discussion at this afternoon’s Consultation Task Force meeting, we reached consensus to continue to require face coverings in all indoor classes and public-facing offices and to recommend masks in all other areas.”

Per Judy Sep 23: “As I stated in my original message, this change does not eliminate the ability of faculty and managers to require masking in their respective instructional and public-facing areas or the ability of individual employees to continue to wear masks as they choose.”

We attended a week’s worth of “opening day” events in person where this could have been announced, addressed, and discussed.

It’s been said, “if you’re not at the table, you’re on the menu.” Currently we’ve been reduced to the bare minimum entitled to us by virtue of our position. Our agreement has been violated, our demand to bargain remains unresolved, and to date our voice has been disregarded.

I am committed to keeping you informed. I do my best to keep these communications as factual as possible, but there are circumstances when it is challenging not to be agitated. ACE continues to fight for dignity and respect on the job for the members we represent.

In Solidarity,

Scott Olsen (he/him) | ACE President

https://acefhda.org | olsenscott@fhda.edu

650-949-7789 | M-F 8:00am-5:00pm